Frequently Asked Questions

No. We use another principle of Modern Portfolio Theory called the “Single Index Model” of returns which we have found is better, if properly implemented. We have found several problems with the Markowitz method:

- If you design a portfolio one month then again a month later, the two portfolios will be significantly different. This is because the market characteristics are very noisy and always changing.

- Markowitz portfolios work best with uncorrelated investments but over the years all equity markets are becoming more highly correlated.

- In spite of these problems, most “asset allocation” portfolios have worked fairly well over the past few decades because they contained bonds, which are negatively correlated with stocks. This reduced portfolio volatility and added to returns as interest rates were decreasing. But now that interest rates are expected to stay low or start increasing, holding bonds can significantly lower the returns.

No. If you have to recommend some strategy that works if everybody uses it, then “asset allocation” is probably the best choice. There are better methods but they stop working if everybody tries to use them.

For example, if there were a perfect market timing system that told everybody when to get in to and out of the market, it would not work because if everybody tried to buy or sell their positions at the same time, there would be no one on the other side of their trades.

There are what economists call “inefficiencies” in all markets and those people with the better skills or better tools are often able to capitalize on them to achieve better than average results. But many of these methods would stop working if everybody tried to use them.

The textbook method for measuring these uses the intercept and slope of a linear regression line. We have found this to be inadequate for several reasons:

- The results using this method are very noisy and in some cases, very inaccurate.

- That method uses weeks to months of past data and calculates the value as it was at the center of the data interval. We really need a more current value.

- The method give reasonable results if the Alpha and Beta are unchanging but does not work well with real market data since those values are constantly changing.

We have developed much more accurate methods over the past decade so our values will often differ from the textbook method.

There are many scholarly studies that show that the markets are not really “efficient” and that momentum investing, for example, can create positive Alpha.

Economic theory is a great starting point but we believe what we can measure and we find many stocks with a positive alpha that persists for many years, as you can see in our charts.

That depends on many factors including what design parameters are used and how often the portfolio is revised. More frequent revisions can achieve higher returns but with higher transaction costs. Here are two real examples:

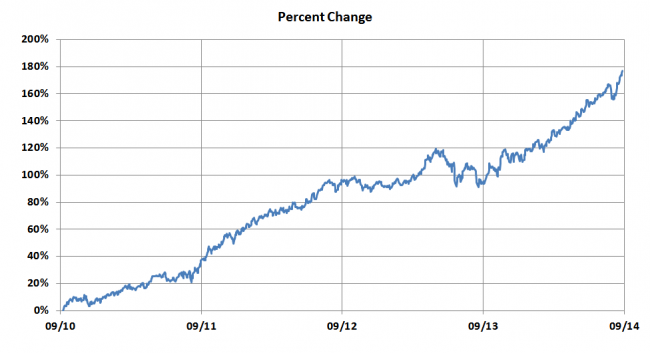

- The chart below shows a real portfolio designed for a long-term investor with about 20 stocks, rebalancing the hedge and changing perhaps one stock about every month or two.

- This chart shows the performance of a more aggressive real portfolio.

When a new portfolio is designed, it will typically be showing a high rate of return since it is using stocks specifically chosen for that characteristic. But over time, the performance will deteriorate as the performance of some of the stocks start decreasing. The ultimate results still depend upon the user’s skill in deciding when to switch out securities but the sophisticated tools we provide in the Portfolio Workbench greatly simplify the process.

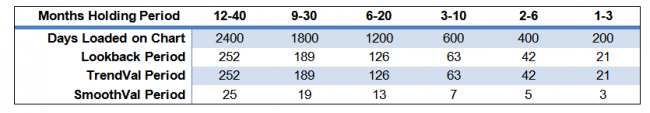

The design method works on any time scale, even down to trade times of minutes. But since the Portfolio Workbench uses daily data, the practical range of holding periods is perhaps one month to a few years. The chart below shows the parameter values that are useful for various holding period objectives for a typical multi-security portfolio.

Trading a single security or a “pairs-trade” can be much shorter and has a typically holding period of a few days.

In theory, yes, but different position sizes make it more difficult to replace poorly performing stocks. And the optimum position sizes would vary over time raising transaction costs if we rebalanced frequently. So in practice, we tend to stick with near equal position sizes.